Alternative Investments

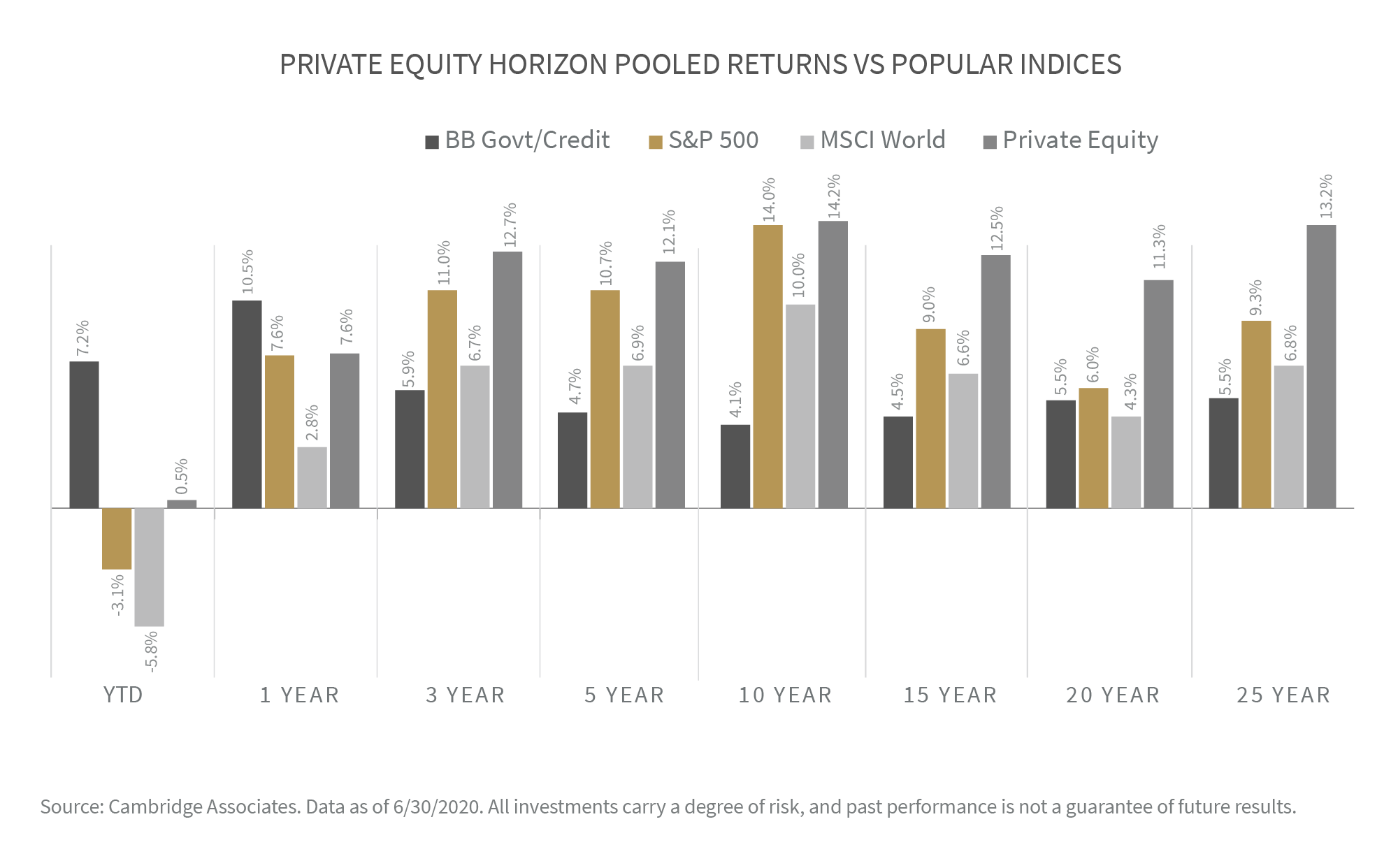

Over the past 20 years, capital markets have greatly evolved, making private capital and investing in private companies more relevant than ever before. In the last decade alone, the number of publicly traded companies has been cut in half, and companies are staying private for much longer. Many people trying to invest in the full US economy are unaware that owning a portion of the s&p 500 index or other index funds only captures a minor portion of all that is out there. It is often difficult for individuals to encompass this wide of a target, but alternatives provide a solution.

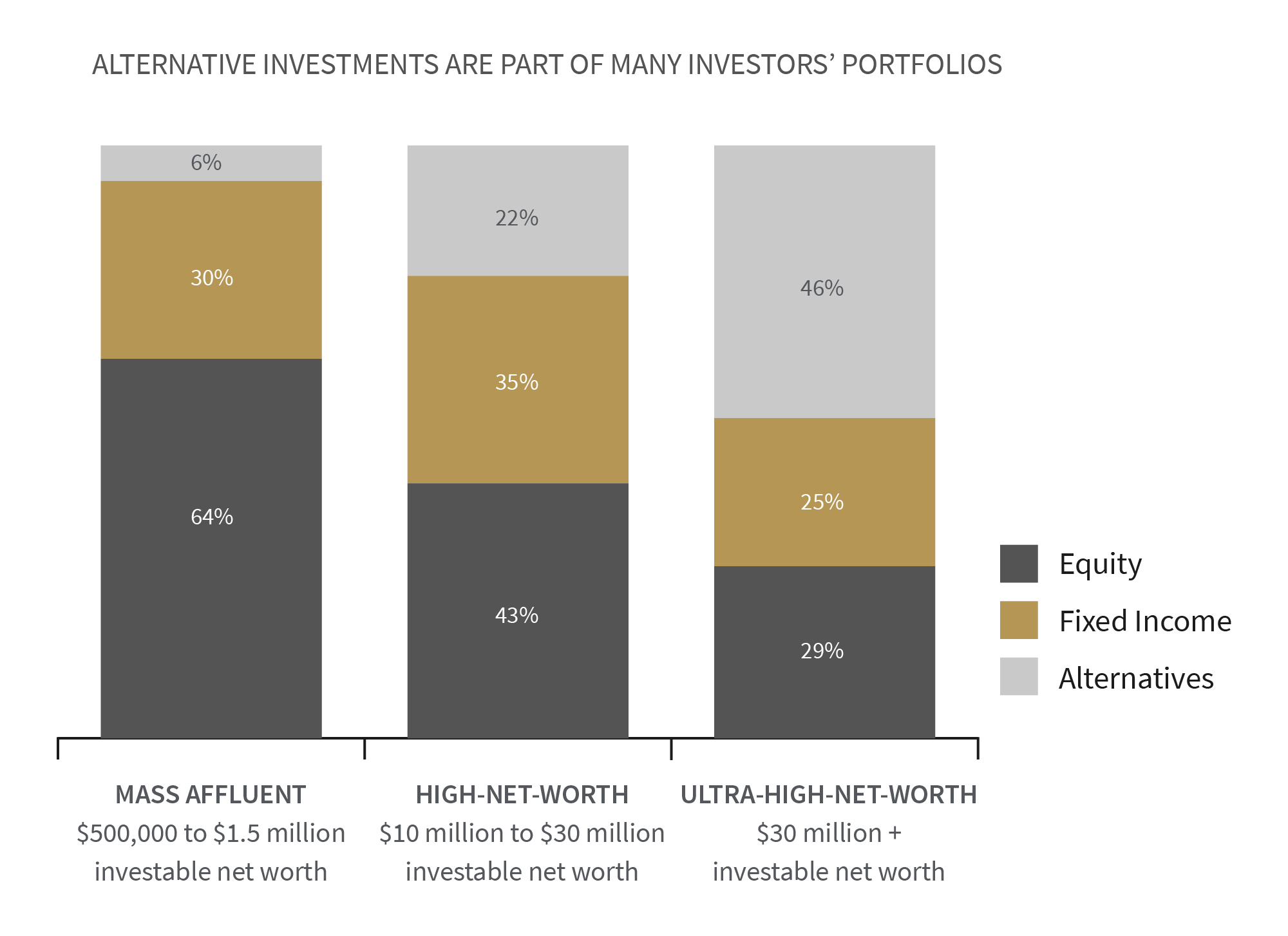

Diversification plays a critical role in wealth management, as portfolio construction should be more concerned with the management of risk than the strive for return, for through proper allocation return will follow. Sophisticated investors with an ability to endure illiquidity may enhance their long-term returns while also lessening their overall risk by including alternative investments in their portfolios. These investments primarily include, but are not limited to private equity, international real estate, private credit, and venture capital. Given our high volume in and dedication to the space, we are able to provide our clients with access to alternative investments that are designed to enhance performance over the long run.

Through a close relationship with the Alternative Investment team at Raymond James, Brock and his team gain access to quality and specialized investment firms in the world. Raymond James is very selective in the opportunities available for clients, offering roughly 15 investments per year. Of this, Brock and John continue the due diligence process and narrow it down to 3-5 investments that they then show their clients. In the past, Kidd Private Wealth Group has partnered with Carlyle, Blackstone, KKR, Summit Partners, Owl Rock, and a few others, maintaining strong relationships with these investment teams that have continued to provide outperformance with steady risk metrics.

Ultimately, for high and ultra-high net worth investors who can tolerate the illiquidity with a percentage of their portfolio, Brock and his team believe that Alternative Investments can play a very important part of achieving their long-term goals. This solution is a great way for investors to create a heat map that targets all sectors of the economy, both domestically and internationally, that are not covered on the public side, which will lead to further diversification and more long-term success.